Valued at a market cap of $52.1 billion, L3Harris Technologies, Inc. (LHX) is a leading American aerospace and defense technology company. Headquartered in Melbourne, Florida, it provides advanced mission-critical solutions across air, land, sea, space, and cyber domains. The company specializes in communication systems, avionics, surveillance and reconnaissance equipment (ISR), electronic warfare, space systems, and missile propulsion through its Aerojet Rocketdyne division.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and LHX fits the label perfectly. It remains one of the largest global defense contractors with a diversified technology portfolio and strong strategic positioning.

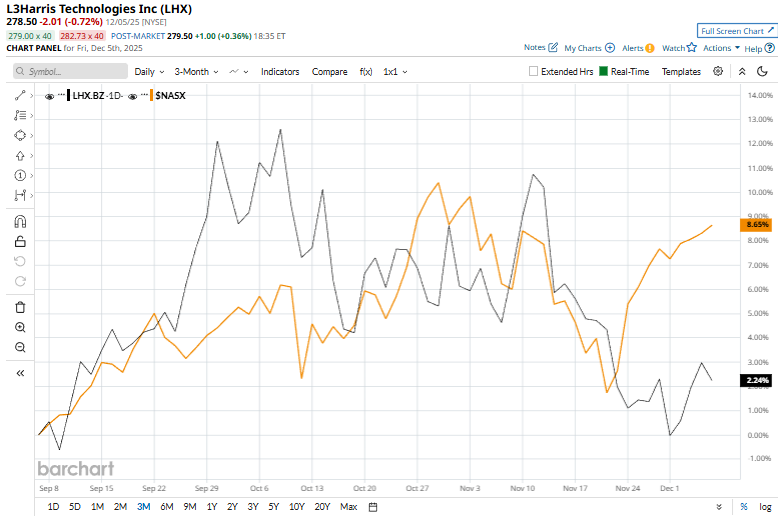

Shares of the aerospace and defense leader have declined 9.6% from its 52-week high of $308.12, reached on Oct. 9. LHX stock has soared 2.2% over the past three months, trailing the Nasdaq Composite’s ($NASX) 8.7% rise during the same time frame.

LHX stock has gained 17% over the past 52 weeks, slightly underperforming NASX’s 19.7% uptick over the same time period. However, on a YTD basis, shares of LHX are up 32.4%, outperforming NASX’s 22.1% rise.

LHX stock has been trading above its 200-day moving average since mid-May and has dipped below its 50-day moving average since mid-November.

On Nov. 21, L3Harris Technologies fell more than 2% as defense stocks slid following reports of a US-Russia peace plan to end the war in Ukraine.

LHX stock has considerably outperformed its rival, Lockheed Martin Corporation (LMT), which declined 12.6% over the past 52 weeks and 5.4% on a YTD basis.

The stock has a consensus rating of "Moderate Buy” from the 20 analysts covering it, and the mean price target of $331.31 represents a premium of 19% to current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart