News

Dutch Bros' stock jumped 18% before the market opened, then dropped to a modest price drop instead. Here's what spooked investors.

Via The Motley Fool · February 13, 2026

Both January's nonfarm payrolls report and the Consumer Price Index came in better than expected, yet the market has not responded well.

Via The Motley Fool · February 13, 2026

Dogecoin tends to move with the broader crypto sector.

Via The Motley Fool · February 13, 2026

Via PRLog · February 13, 2026

NEW YORK – After a harrowing session that saw the Dow Jones Industrial Average surrender its hard-won 50,000 milestone, Wall Street found a fragile floor on Friday, February 13, 2026. An encouraging inflation update provided the necessary cooling effect to a market that had been boiling over with anxiety just

Via MarketMinute · February 13, 2026

The Fed is already cutting rates and printing $40 billion per month and using the money to buy U.S. debt. To put those actions into perspective, the Fed usually does this during recessions to cushion the economic fallout.

Via Talk Markets · February 13, 2026

Bladex (BLX) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 13, 2026

The U.S. labor market kicked off 2026 with an unexpected surge, as the January nonfarm payrolls report shattered analyst expectations and provided a much-needed jolt to the economic outlook. Adding 130,000 jobs—nearly double the consensus forecast of 65,000—the "blowout" report signals that the American economy

Via MarketMinute · February 13, 2026

In a day defined by sharp reversals and a fundamental recalibration of market leadership, the healthcare sector emerged as the primary beneficiary of a massive capital rotation on February 13, 2026. While the broader indices grappled with a "valuation reset" triggered by shifts in Federal Reserve leadership and a cooling

Via MarketMinute · February 13, 2026

In a decisive shift for equity markets, the small-cap heavy Russell 2000 index outperformed its large-cap peers on Friday, February 13, 2026, as investors cheered a cooler-than-expected Consumer Price Index (CPI) report. The surge reflects a growing market consensus that the Federal Reserve may accelerate its rate-cutting cycle, providing much-needed

Via MarketMinute · February 13, 2026

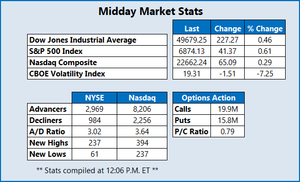

Stocks are trading higher midday, after weaker-than-expected inflation data boosted investor sentiment.

Via Talk Markets · February 13, 2026

NEW YORK — On February 13, 2026, a seismic shift rattled Wall Street as the long-standing "AI-at-any-price" trade finally met its match. In a session that market veterans are already calling "Software-mageddon," investors staged a violent rotation out of high-growth technology sectors and into the unglamorous but steady arms of Utilities

Via MarketMinute · February 13, 2026

The U.S. bond market experienced a seismic shift on February 13, 2026, as the 10-year Treasury yield plummeted to 4.06% in response to a cooler-than-expected Consumer Price Index (CPI) report. This move marks a significant departure from the volatile interest rate environment that characterized much of 2025, suggesting

Via MarketMinute · February 13, 2026

In a high-stakes interview on February 13, 2026, Goldman Sachs (NYSE: GS) CEO David Solomon painted a remarkably optimistic picture of the American economy, describing the current macroeconomic setup as "quite good." Speaking on CNBC, Solomon pointed to a confluence of aggressive US deregulation and a historic surge in artificial

Via MarketMinute · February 13, 2026

In a move that has sent shockwaves through both the Silicon Valley tech scene and the skyscrapers of Manhattan, Electronic Arts (NASDAQ: EA) is set to depart the public markets in a landmark $55 billion take-private acquisition. The deal, spearheaded by a powerhouse consortium including Saudi Arabia’s Public Investment

Via MarketMinute · February 13, 2026

The Dow Jones Industrial Average faced significant headwinds on February 13, 2026, as networking giant Cisco Systems (NASDAQ:CSCO) saw its shares plummet following a cautionary update on its fiscal outlook. Despite reporting headline earnings that beat analyst expectations, the company’s warning of ballooning operating expenses and a dramatic

Via MarketMinute · February 13, 2026

BOSTON — In a move that left Wall Street scratching its head, DraftKings (NASDAQ: DKNG) reported a blowout fourth-quarter performance today, February 13, 2026, featuring profits that nearly tripled analyst expectations. However, the celebration was short-lived as a "conservative" and disappointing revenue guidance for the 2026 fiscal year sent shares screaming

Via MarketMinute · February 13, 2026

The U.S. Bureau of Labor Statistics delivered a long-awaited "Valentine’s Day eve" gift to the markets on Friday, February 13, 2026, reporting that consumer prices cooled more than expected in January. Headline inflation fell to 2.4% on a year-over-year basis, undercutting the 2.5% consensus forecast from

Via MarketMinute · February 13, 2026

Amazon.com stock has lost about 17.5% of its value in the last one month, even as the company’s shares hover near their lowest level since May 23, 2025.

Via Stocktwits · February 13, 2026

As of February 13, 2026, the financial landscape is undergoing a violent restructuring. After a historic run that saw the S&P 500 (NYSE: SPY) briefly kiss the 7,000 mark in late January, the broader market has entered a period of sharp correction, driven by a combination of "AI

Via MarketMinute · February 13, 2026

As of February 13, 2026, Vanguard has cemented its position not just as a low-cost index provider, but as a dominant force in the evolution of active management and private market access. With global assets under management (AUM) reaching a staggering $11.6 trillion and its exchange-traded fund (ETF) segment

Via MarketMinute · February 13, 2026

The U.S. housing market reached a pivotal turning point on February 13, 2026, as a "goldilocks" inflation report collided with a massive wave of industry consolidation. The Bureau of Labor Statistics released the January Consumer Price Index (CPI) this morning, revealing that headline inflation has cooled to 2.4%

Via MarketMinute · February 13, 2026

As of February 13, 2026, the American consumer is signaling a profound state of distress that stands in stark contrast to the resilient spending patterns seen just two years ago. The latest reading of the University of Michigan’s Consumer Sentiment Index has plummeted to 57.3, its lowest level

Via MarketMinute · February 13, 2026

The Dow Jones Industrial Average endured a chilling session this Friday, February 13, 2026, dropping 267.77 points, or 0.54%, to close at 49,184.21. The slide marked the second consecutive day of losses for the blue-chip index, following a more severe 669-point tumble on Thursday. What began

Via MarketMinute · February 13, 2026

As the opening bell rang on February 13, 2026, the divergence between the U.S. technology and healthcare sectors reached a historic fever pitch, signaling a fundamental shift in how markets price growth and defense. While the technology sector continues to ride a wave of massive capital investment into artificial

Via MarketMinute · February 13, 2026