Latest News

Gold holds above $5,000 after a sharp selloff and rebound, while silver suffers an extreme intraday collapse and the media declares a “silver bubble” — missing the bigger picture: a historic breakout and a new base forming.

Via Talk Markets · February 13, 2026

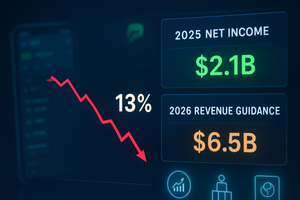

Amazon stock is plummeting following the company's fourth-quarter earnings report.

Via The Motley Fool · February 13, 2026

Nasty set of red candlesticks painted the market, but most of these occurred within the context of trading ranges.

Via Talk Markets · February 13, 2026

Retail investors are now looking forward to a full approval of Anktiva in the EU for BCG-unresponsive non-muscle invasive bladder cancer (NMIBC) with carcinoma in situ.

Via Stocktwits · February 13, 2026

Via MarketBeat · February 13, 2026

After rocketing parabolic in a popular speculative mania, silver violently crashed. It suffered some of its biggest down days ever in recent weeks, shockingly-brutal plummeting

Via Talk Markets · February 13, 2026

U.S. trade officials are finally recognizing that tariffs on essential metal products are hurting manufacturers and ultimately consumers.

Via Talk Markets · February 13, 2026

Britney Spears sells her music catalog, while Mercedes, Warner Bros, and Francesca's drive major deals and restructurings.

Via Benzinga · February 13, 2026

This week’s market narrative revolved around three intersecting forces: the scale of AI capital investment, macroeconomic recalibration of Fed policy, and crypto-driven liquidity swings.

Via Talk Markets · February 13, 2026

According to a report from the Wall Street Journal from Friday, the cuts will help the company focus on its store employees.

Via Stocktwits · February 13, 2026

The company's wide selection, fast delivery options, and improved affordability are resonating with consumers.

Via The Motley Fool · February 13, 2026

This high-flying chip stock is poised to deliver further gains over the next three years.

Via The Motley Fool · February 13, 2026

Nine U.S. Army Soldier-athletes and coaches and two alternates are representing the country in Italy, joining thousands of elite athletes competing on the world stage.

Via Brandpoint · February 13, 2026

Goolsbee said that inflation is stuck at 3% and that’s not acceptable.

Via Stocktwits · February 13, 2026

The S&P 500 just closed at 6,850. That puts it right on the bottom of a range it has traded inside for months.

Via Talk Markets · February 13, 2026

Many eyes will be on its massive equity portfolio and its cash holdings.

Via The Motley Fool · February 13, 2026

This China-based tech firm delivers online marketing, cloud computing, and digital entertainment services to businesses and consumers.

Via The Motley Fool · February 13, 2026

Positive earnings pushed Applied Materials and Rivian Automotive higher as better-than-expected inflation data helped steady markets today, Feb. 13, 2026.

Via The Motley Fool · February 13, 2026

According to BlockTower founder Ari Paul, crypto markets are at a critical juncture and face two sharply different outcomes.

Via Benzinga · February 13, 2026

The company said that the decision to layoff 64% of its workforce was approved by its board of directions on Feb. 9.

Via Stocktwits · February 13, 2026

The Dollar bounced around, but could not take back the 97 handle.

Via Talk Markets · February 13, 2026

Under the decisive leadership of CEO Brian Niccol, Starbucks (NASDAQ:SBUX) has reached a pivotal milestone in its multi-year "Back to Starbucks" transformation. As of February 2026, the Seattle-based coffee giant is reporting its first sustained period of domestic traffic growth in two years, a feat attributed to its "National

Via MarketMinute · February 13, 2026

The financial landscape shifted violently this week as the long-dormant Russell 2000 index (INDEXRUSSELL:RUT) staged a breathtaking 18% rally, marking its best single-week performance in decades. Triggered by a surprisingly soft Consumer Price Index (CPI) report released on Wednesday, the surge has ignited what analysts are calling "The Great

Via MarketMinute · February 13, 2026

Silver climbs to $77.20 after softer US CPI boosts expectations of Fed easing.

Via Talk Markets · February 13, 2026

Today, Feb. 13, 2026, investors are weighing tariff-hit ad budgets and fresh layoffs against surging user growth at Pinterest.

Via The Motley Fool · February 13, 2026

An SEC filing from Feb. 11 revealed that CEO Lourenco Goncalves had sold 3 million shares of Cleveland-Cliffs for about $12.42 each.

Via Stocktwits · February 13, 2026

NEW YORK – In a move that has sent ripples through the global financial markets, Morgan Stanley (NYSE: MS) officially announced an 11.7% increase in its quarterly common stock dividend in early February 2026. The hike, which brings the quarterly payout to a record level for the firm, was timed

Via MarketMinute · February 13, 2026

Walmart has a knack for staying ahead of the e-commerce revolution.

Via Investor's Business Daily · February 13, 2026

As the dust settles on the fourth-quarter 2025 earnings season, Martin Marietta Materials (NYSE: MLM) has emerged as a critical barometer for the health of the American industrial landscape. Reporting its results on February 11, 2026, the building materials giant showcased a bifurcated reality: while the broader economy grapples with

Via MarketMinute · February 13, 2026

Partnering with companies building generative AI models has been a boon to Innodata.

Via The Motley Fool · February 13, 2026

The era of worrying about chip shortages has officially ended, only to be replaced by a far more daunting physical constraint: the "Energy Wall." As of February 13, 2026, the artificial intelligence sector has hit a critical juncture where the availability of raw electrical power—not silicon—is the primary

Via MarketMinute · February 13, 2026

2025 was a really good year for T-Mobile: it led Verizon and AT&T on postpaid growth, new accounts, and fixed wireless.

Via Talk Markets · February 13, 2026

The U.S. bond market experienced a significant easing on February 13, 2026, as the benchmark 10-year Treasury yield slid to 4.06% following a highly anticipated Consumer Price Index (CPI) report. The data, which showed inflation continuing its steady descent toward the Federal Reserve’s long-term target, provided a

Via MarketMinute · February 13, 2026

Westwood (WHG) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 13, 2026

The digital "inspiration engine" is facing a cold reality check. Shares of Pinterest Inc. (NYSE: PINS) plummeted 14.2% in early trading on February 13, 2026, following a disappointing fourth-quarter earnings report and a cautious outlook for the year ahead. Despite achieving a record-breaking milestone in its global user base,

Via MarketMinute · February 13, 2026

Humana Inc. (NYSE: HUM) sent shockwaves through the managed care sector this week, issuing a 2026 earnings forecast that fell drastically short of Wall Street’s expectations. Despite reporting a fourth-quarter 2025 earnings beat on February 11, the health insurance giant warned that its 2026 adjusted earnings per share (EPS)

Via MarketMinute · February 13, 2026

Fastly advances after record results and stronger guidance highlighted its growing role in supporting AI-related traffic across cloud infrastructure.

Via The Motley Fool · February 13, 2026

Investors weigh fresh profit milestones against a sharply reset 2026 growth path, today, Feb. 13, 2026.

Via The Motley Fool · February 13, 2026

Following a tumultuous period of "fast-food fatigue" and inflationary pressure, McDonald’s (NYSE:MCD) has emerged from its fiscal 2025 fourth quarter as a definitive bellwether for the American economy. Two days ago, on February 11, 2026, the fast-food giant reported a "double beat" on revenue and earnings, signaling that

Via MarketMinute · February 13, 2026

The digital infrastructure market reached a historic turning point this week as Equinix, Inc. (NASDAQ: EQIX) unveiled a 2026 outlook that shattered analyst expectations, sending its shares climbing more than 10%. The data center giant issued revenue guidance for the 2026 fiscal year between $10.12 billion and $10.22

Via MarketMinute · February 13, 2026

In a move that fundamentally reshapes the landscape of government technology, Oracle (NYSE: ORCL) has officially secured a massive, multi-billion-dollar contract with the Centers for Medicare and Medicaid Services (CMS). Announced on February 11, 2026, the deal tasks Oracle Cloud Infrastructure (OCI) with the complete migration and management of mission-critical

Via MarketMinute · February 13, 2026

This off-price retailer leverages closeout sourcing to deliver brand-name merchandise at value prices across more than 450 U.S. stores.

Via The Motley Fool · February 13, 2026

As of February 13, 2026, the S&P 500 (NYSE: SPY) has officially crossed a psychological and mathematical Rubicon. The Shiller CAPE ratio—a measure of the market’s price relative to ten years of inflation-adjusted earnings—surpassed the 40.0 mark this week, currently hovering at 40.6. This

Via MarketMinute · February 13, 2026

In a move that has sent shockwaves through global financial centers, the White House has officially nominated Kevin Warsh to serve as the next Chairman of the Federal Reserve. Scheduled to take the gavel on May 15, 2026, Warsh will succeed Jerome Powell, whose second four-year term ends this spring.

Via MarketMinute · February 13, 2026

The world's second-largest cryptocurrency is up more than 7% today.

Via The Motley Fool · February 13, 2026

The mid-February 2026 market landscape has taken a sharp turn into volatility as a new wave of "AI disruption" fears sweeps through traditional service sectors. Long considered immune to the initial wave of generative AI, labor-intensive giants in logistics and real estate are now facing a reckoning. Investors, once enamored

Via MarketMinute · February 13, 2026

The high-stakes world of online gaming met a harsh reality check on Friday as shares of DraftKings Inc. (Nasdaq: DKNG) plummeted 13.4%, wiping out billions in market capitalization in a single trading session. The sell-off came despite the Boston-based operator reporting its first-ever year of positive net income in

Via MarketMinute · February 13, 2026

On Feb. 13, 2026, an earnings beat, strong 2026 delivery outlook, and R2 launch plans sharpened the market's focus on Rivian's growth path.

Via The Motley Fool · February 13, 2026

American Superconductor rallied on a blog post mentioning its next-generation technology.

Via The Motley Fool · February 13, 2026

Moderna Inc. (NASDAQ: MRNA) shares jumped 8% in early trading on February 13, 2026, after the biotechnology pioneer reported fourth-quarter 2025 financial results that exceeded Wall Street’s expectations. Despite reporting a net loss, the company’s narrower-than-anticipated deficit of $2.11 per share and revenue of $678 million signaled

Via MarketMinute · February 13, 2026