Over the last six months, Calavo’s shares have sunk to $20.33, producing a disappointing 12.3% loss - a stark contrast to the S&P 500’s 13.4% gain. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Calavo, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think Calavo Will Underperform?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons you should be careful with CVGW and a stock we'd rather own.

1. Revenue Spiraling Downwards

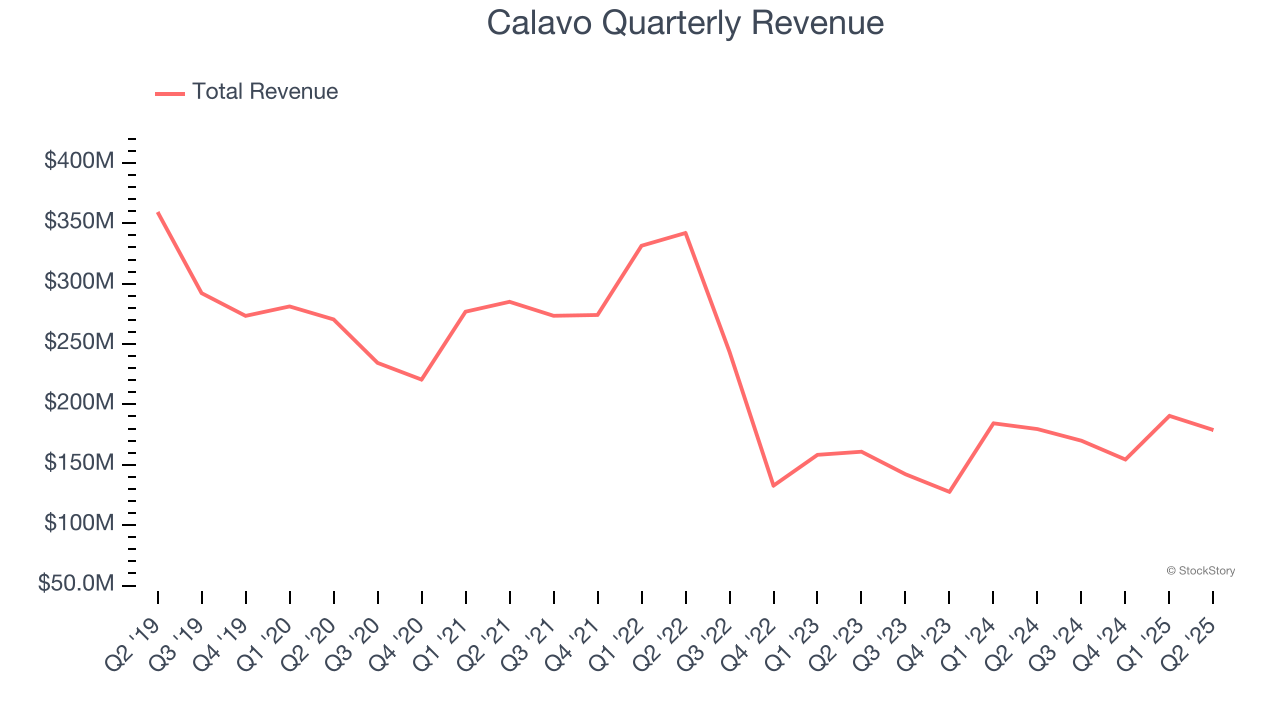

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Calavo’s demand was weak and its revenue declined by 17.2% per year. This wasn’t a great result and signals it’s a low quality business.

2. Fewer Distribution Channels Limit its Ceiling

With $693.7 million in revenue over the past 12 months, Calavo is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

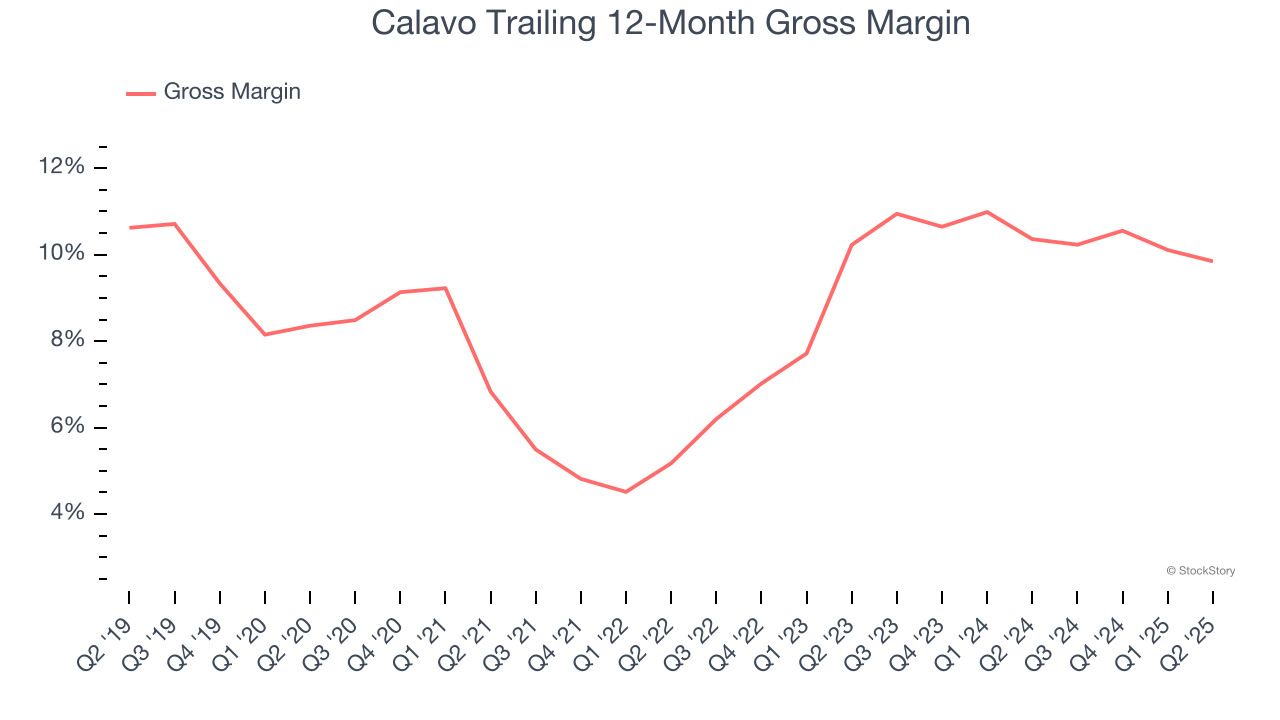

3. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Calavo has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 10.1% gross margin over the last two years. That means Calavo paid its suppliers a lot of money ($89.91 for every $100 in revenue) to run its business.

Final Judgment

We see the value of companies helping consumers, but in the case of Calavo, we’re out. After the recent drawdown, the stock trades at 11.6× forward P/E (or $20.33 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better stocks to buy right now. Let us point you toward one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Calavo

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.