Wrapping up Q3 earnings, we look at the numbers and key takeaways for the aerospace stocks, including Woodward (NASDAQ:WWD) and its peers.

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

The 13 aerospace stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 2% while next quarter’s revenue guidance was 0.7% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Woodward (NASDAQ:WWD)

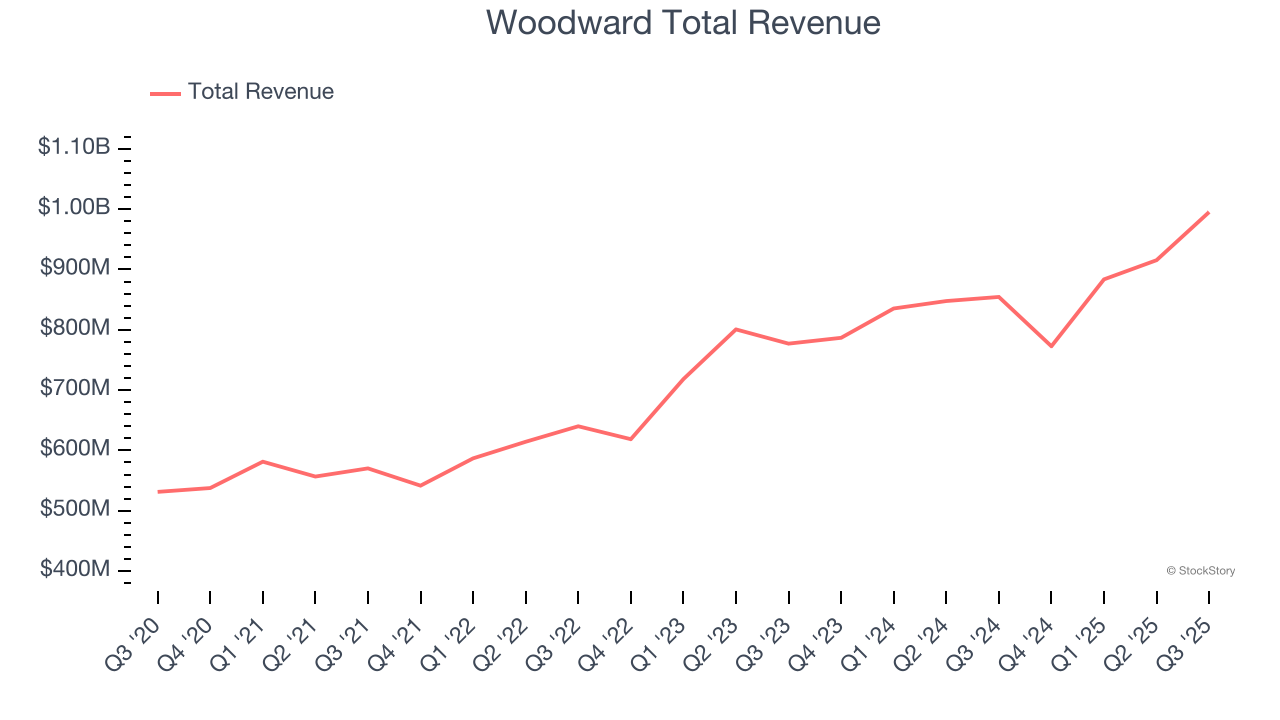

Initially designing controls for water wheels in the early 1900s, Woodward (NASDAQ:WWD) designs, services, and manufactures energy control products and optimization solutions.

Woodward reported revenues of $995.3 million, up 16.5% year on year. This print exceeded analysts’ expectations by 5.9%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ EBITDA estimates.

Interestingly, the stock is up 14.8% since reporting and currently trades at $304.34.

Is now the time to buy Woodward? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: AAR (NYSE:AIR)

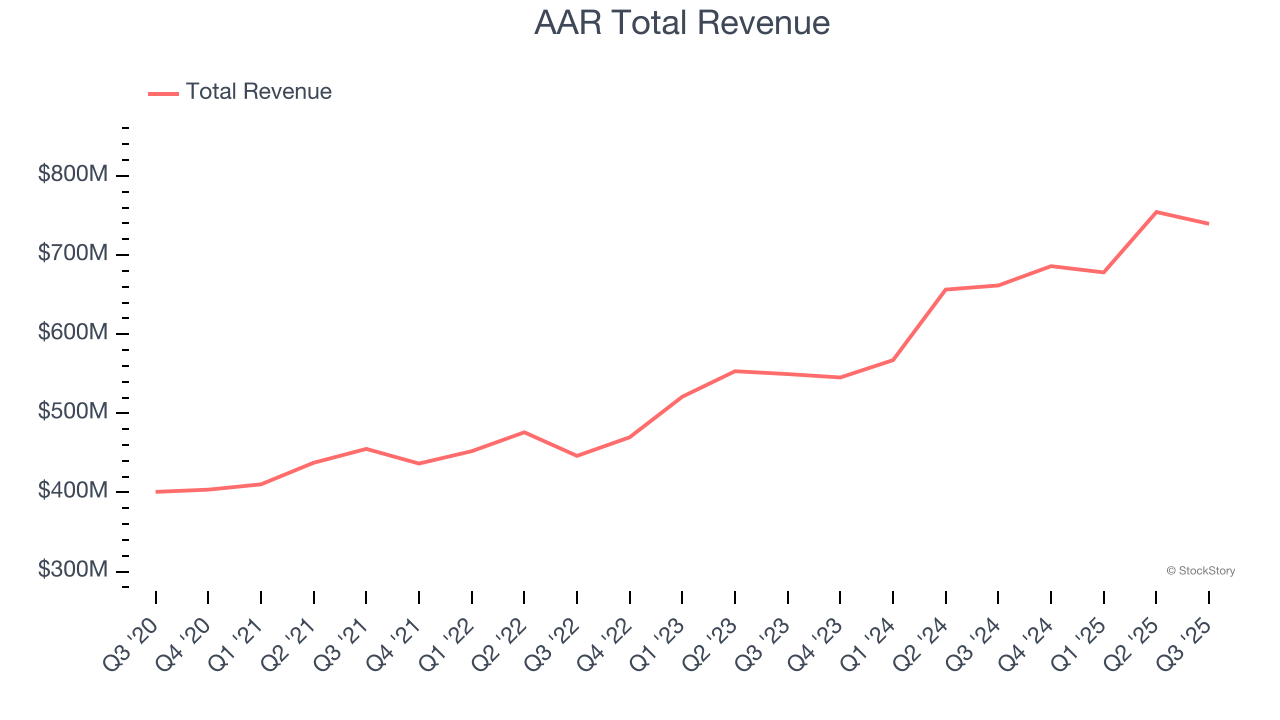

The first third-party MRO approved by the FAA for Safety Management System Requirements, AAR (NYSE:AIR) is a provider of aircraft maintenance services

AAR reported revenues of $739.6 million, up 11.8% year on year, outperforming analysts’ expectations by 7.4%. The business had an exceptional quarter with a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ revenue estimates.

AAR achieved the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 3.8% since reporting. It currently trades at $82.71.

Is now the time to buy AAR? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Redwire (NYSE:RDW)

Based in Jacksonville, Florida, Redwire (NYSE:RDW) is a provider of systems and components used in space infrastructure.

Redwire reported revenues of $103.4 million, up 50.7% year on year, falling short of analysts’ expectations by 22.4%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and a significant miss of analysts’ revenue estimates.

As expected, the stock is down 13.8% since the results and currently trades at $6.37.

Read our full analysis of Redwire’s results here.

Textron (NYSE:TXT)

Listed on the NYSE in 1947, Textron (NYSE:TXT) provides products and services in the aerospace, defense, industrial, and finance sectors.

Textron reported revenues of $3.60 billion, up 5.1% year on year. This print missed analysts’ expectations by 1.9%. More broadly, it was a mixed quarter as it also logged a solid beat of analysts’ EBITDA estimates but a miss of analysts’ revenue estimates.

The stock is up 1.1% since reporting and currently trades at $83.48.

Read our full, actionable report on Textron here, it’s free for active Edge members.

Howmet (NYSE:HWM)

Inventing the first forged aluminum truck wheel, Howmet (NYSE:HWM) specializes in lightweight metals engineering and manufacturing multi-material components used in vehicles.

Howmet reported revenues of $2.09 billion, up 13.8% year on year. This number surpassed analysts’ expectations by 2.3%. Overall, it was a strong quarter as it also logged an impressive beat of analysts’ Engine products revenue estimates and an impressive beat of analysts’ Fastening systems revenue estimates.

The stock is down 6.6% since reporting and currently trades at $190.07.

Read our full, actionable report on Howmet here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.