Sporting goods retailer Academy Sports & Outdoor (NASDAQ:ASO) met Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 6.6% year on year to $1.68 billion. On the other hand, the company’s full-year revenue guidance of $6.18 billion at the midpoint came in 1% below analysts’ estimates. Its non-GAAP profit of $1.96 per share was 7.6% above analysts’ consensus estimates.

Is now the time to buy Academy Sports? Find out by accessing our full research report, it’s free.

Academy Sports (ASO) Q4 CY2024 Highlights:

- Revenue: $1.68 billion vs analyst estimates of $1.68 billion (6.6% year-on-year decline, in line)

- Adjusted EPS: $1.96 vs analyst estimates of $1.82 (7.6% beat)

- Adjusted EBITDA: $211.7 million vs analyst estimates of $203.9 million (12.6% margin, 3.8% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $6.18 billion at the midpoint, missing analyst estimates by 1% and implying 4.1% growth (vs -3.5% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $5.98 at the midpoint, missing analyst estimates by 7.5%

- Operating Margin: 9.2%, down from 11.4% in the same quarter last year

- Free Cash Flow Margin: 5.4%, down from 10% in the same quarter last year

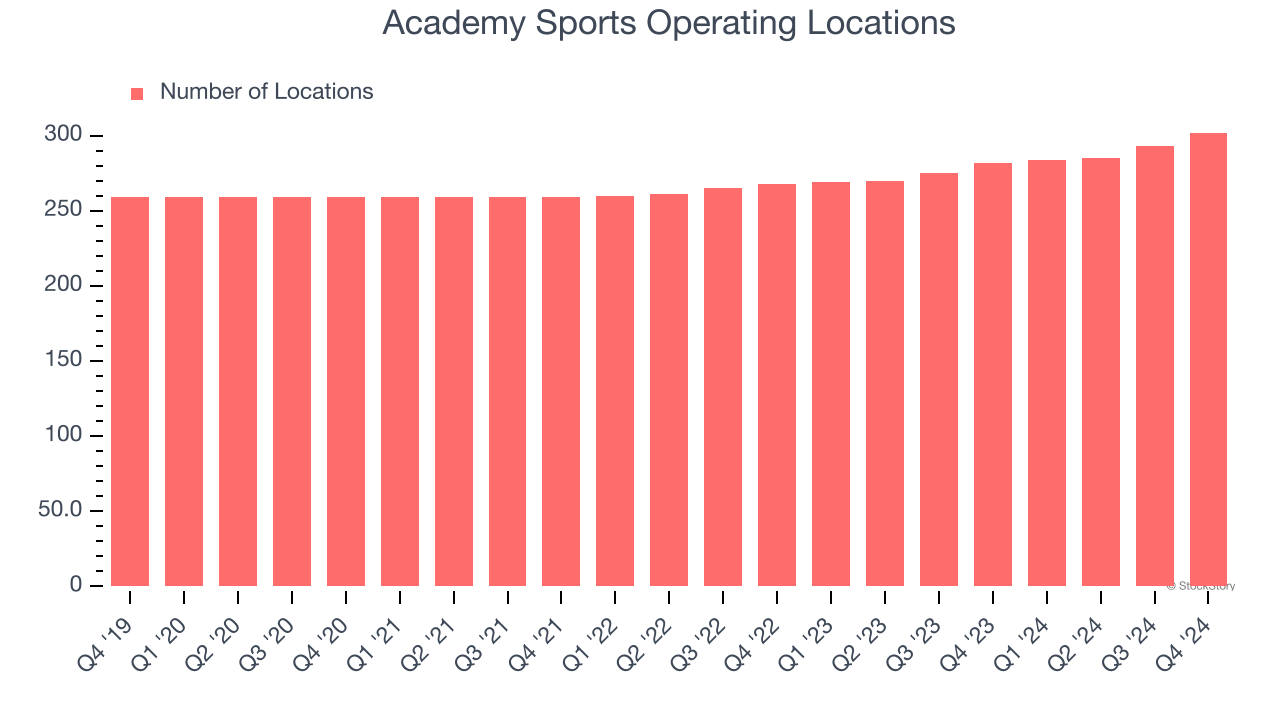

- Locations: 302 at quarter end, up from 282 in the same quarter last year

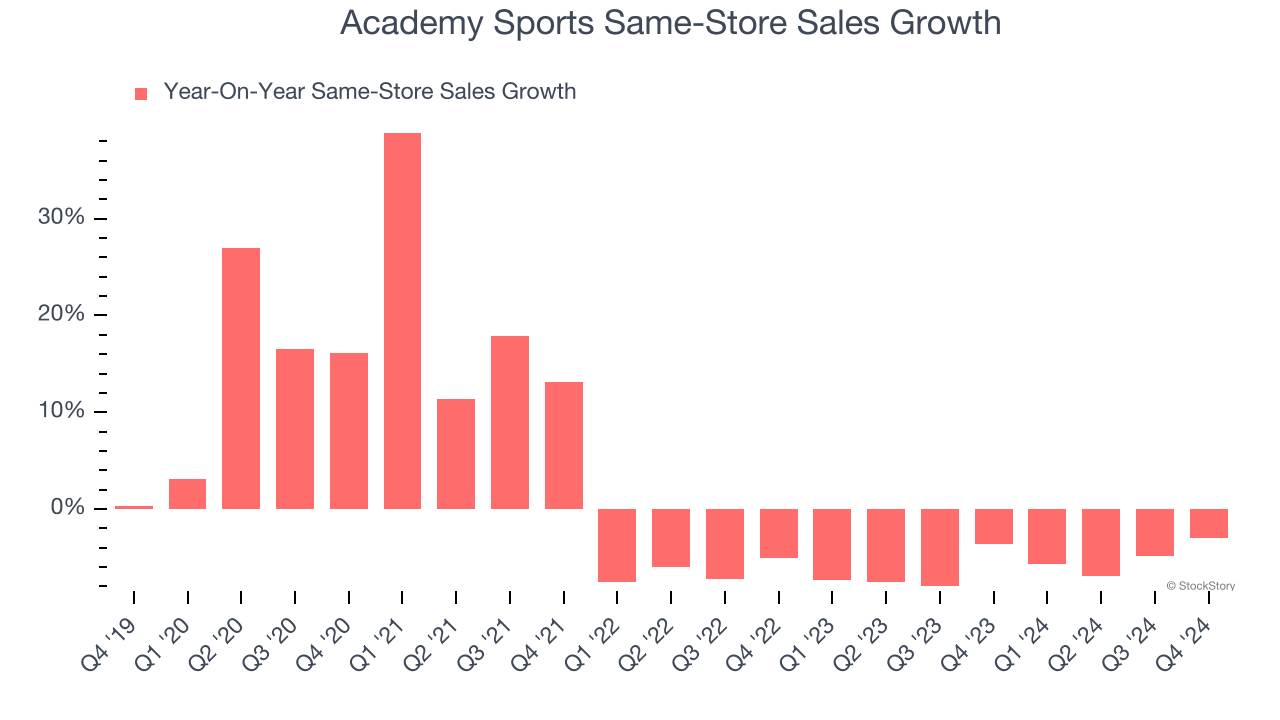

- Same-Store Sales fell 3% year on year, in line with the same quarter last year

- Market Capitalization: $3.3 billion

“Looking back on 2024, our team made significant strides toward achieving our long-term goals, all while thoughtfully navigating a challenging macroeconomic environment. As we head into 2025, we’re energized by the opportunities that lie ahead. The foundation for growth that we’ve built over the past year should yield meaningful results this year and into the future.” said Steve Lawrence, Chief Executive Officer.

Company Overview

Founded in 1938 as a tire shop before expanding into fishing equipment, Academy Sports & Outdoor (NASDAQ:ASO) sells a broad selection of sporting goods but is still known for its outdoor activity merchandise.

Sports & Outdoor Equipment Retailer

Some of us spend our leisure time vegging out, but many others take to the courts, fields, beaches, and campsites; sports equipment retailers cater to the avid sportsman as well as the weekend warrior. Shoppers can find everything from tents to lawn games to baseball bats to satisfy their athletic and leisure needs along with competitive prices and helpful store associates that can talk through brands, sizing, and product quality. This is a category that has moved rapidly online over the last few decades, so these sports and outdoor equipment retailers have needed to be nimble and aggressive with their e-commerce and omnichannel presences.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $5.93 billion in revenue over the past 12 months, Academy Sports is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

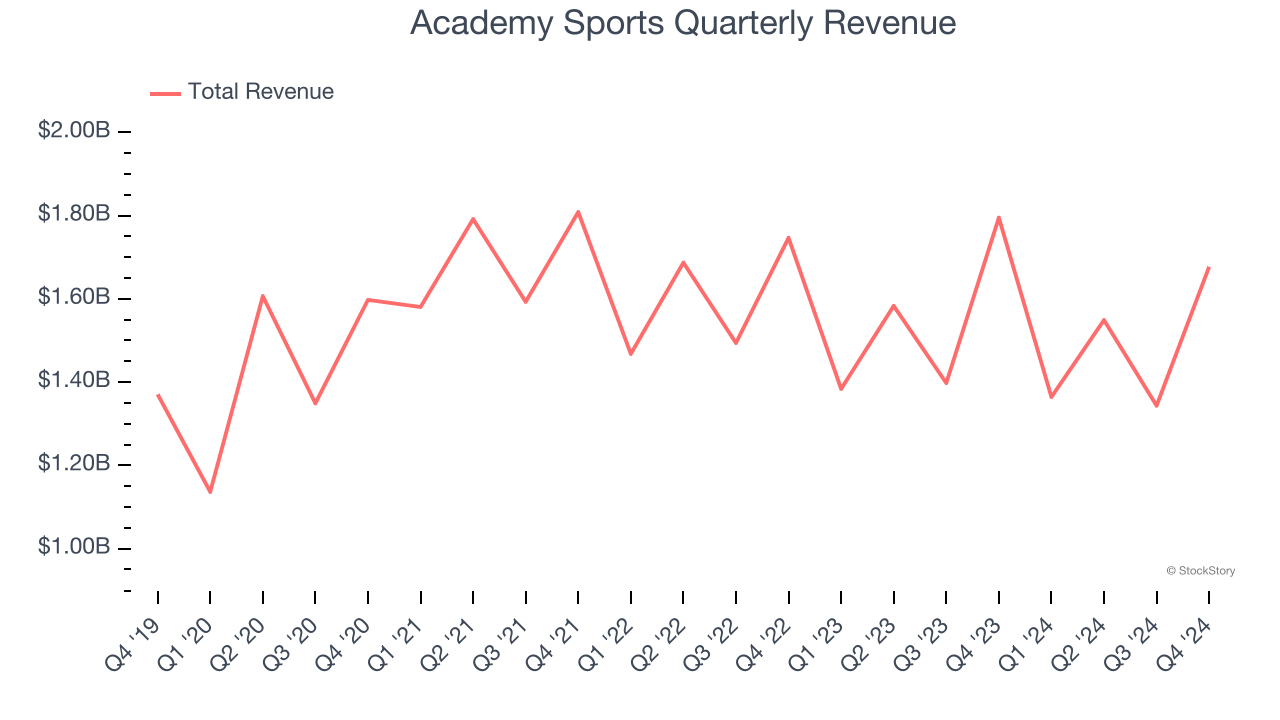

As you can see below, Academy Sports grew its sales at a sluggish 4.2% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Academy Sports reported a rather uninspiring 6.6% year-on-year revenue decline to $1.68 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.1% over the next 12 months, similar to its five-year rate. This projection is commendable and indicates the market sees success for its products.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

Number of Stores

Academy Sports sported 302 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 5.1% annual growth, among the fastest in the consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Academy Sports’s demand has been shrinking over the last two years as its same-store sales have averaged 5.9% annual declines. This performance is concerning - it shows Academy Sports artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, Academy Sports’s same-store sales fell by 3% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Academy Sports’s Q4 Results

We enjoyed seeing Academy Sports beat analysts’ EBITDA expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed significantly and its gross margin fell short of Wall Street’s estimates. Overall, this quarter was mixed. The stock traded up 5.2% to $50 immediately after reporting.

So do we think Academy Sports is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.