Global X Copper Miners ETF (COPX)

79.95

-2.35 (-2.86%)

NYSE · Last Trade: Mar 7th, 5:47 AM EST

Detailed Quote

| Previous Close | 82.30 |

|---|---|

| Open | 80.47 |

| Day's Range | 79.11 - 81.30 |

| 52 Week Range | 30.77 - 99.99 |

| Volume | 8,377,147 |

| Market Cap | 36.04M |

| Dividend & Yield | 3.344 (4.18%) |

| 1 Month Average Volume | 5,381,581 |

Chart

News & Press Releases

These are 5 ETFs I like for this year

Via The Motley Fool · February 16, 2026

Veteran commodities analyst Ole Hansen of Saxo Bank highlighted multiple near-term supply and demand signals that don’t fully justify the rally.

Via Stocktwits · January 29, 2026

Via MarketBeat · January 29, 2026

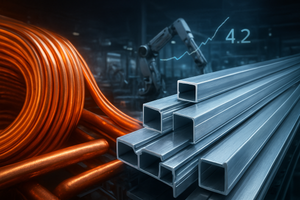

The global commodities market has reached a historic inflection point as of January 2026, with industrial manufacturers aggressively pivoting from copper to aluminum. This shift is no longer a matter of marginal cost-saving; it has become a structural necessity as the copper-to-aluminum price ratio has surged past 4.2, a

Via MarketMinute · January 20, 2026

Barrick Stock Eyes Extending Winning Streak To 5 Days As Retail Bets On $60 Breakoutstocktwits.com

Via Stocktwits · January 14, 2026

As the final trading session of 2025 draws to a close, the precious and industrial metals markets are providing a masterclass in technical resilience. Despite a sharp bout of profit-taking in the final weeks of December, gold, silver, and copper have managed to hold firmly above their critical 50-day moving

Via MarketMinute · December 31, 2025

Via MarketBeat · December 27, 2025

A precious metal and an industrial metal have significant upside potential in 2026.

Via The Motley Fool · December 19, 2025

Copper is increasingly important to the buildout of AI infrastructure.

Via The Motley Fool · November 15, 2025

Copper market faces risks as challenges emerge; Codelco lowers output forecast; Glencore weighs closure of Canadian smelter.

Via Benzinga · November 5, 2025

Copper prices at record high on US-China trade deal hopes, supply disruptions. Industry volatility remains due to production setbacks.

Via Benzinga · October 30, 2025

Copper is breaking out technically and tightening fundamentally. Discover why rising demand, shrinking supply, and investor flows signal a new bull cycle.

Via Benzinga · October 28, 2025

Copper is set for its strongest bull run in decades as supply shocks and rising demand push prices higher. Analysts see 60% gains in copper stocks by 2027.

Via Benzinga · October 27, 2025

Markets surge on optimism for US-China trade truce extension as Asian and US stocks rally, fueled by upcoming summit.

Via Benzinga · October 27, 2025

Argentina's President Javier Milei's party, La Libertad Avanza, won a decisive victory in midterm elections.

Via Benzinga · October 27, 2025

Private equity investors are investing $1B in critical minerals via Appian-IFC fund. This boosts supply chain security and local development.

Via Benzinga · October 22, 2025

The Fed's rate cut signals boosted copper prices by 1.8%, driven by demand from electrification and supply shortages.

Via Benzinga · October 16, 2025

Copper prices are climbing as demand outpaces supply. Here are three top copper stocks and an ETF poised to benefit from the metal’s long-term bull market

Via MarketBeat · October 13, 2025

Copper prices surge to record high due to supply constraints and ESG regulations. Major mines stalled or suspended, causing global deficit.

Via Benzinga · October 10, 2025

The global copper market is shifting from surplus to shortage as supply disruptions, strong demand, and mine delays tighten 2025–2026 outlook.

Via Benzinga · October 9, 2025

Copper prices are on the rise due to supply issues, primarily stemming from a production stoppage at the Grasberg mine in Indonesia, one of the world’s largest copper producers.

Via Benzinga · September 26, 2025

The copper market has been jolted by disruptions at Indonesia’s Grasberg mine, with ripple effects spreading across supply forecasts and price expectations.

Via Benzinga · September 26, 2025

Mining stocks are surging, with gold and silver ETFs posting triple-digit gains. Analysts call it a once-in-a-generation commodity bull run.

Via Benzinga · September 24, 2025

Freeport-McMoRan (FCX) gives update on mud rush at Grasberg mine in Indonesia. Production outlook impacted.

Via Benzinga · September 24, 2025

US govt updating critical minerals list to 54 minerals, adding 6 new ones. Trump aims to reduce dependence on foreign adversaries and spur innovation.

Via Benzinga · August 26, 2025