iShares MSCI Brazil ETF (EWZ)

37.81

+1.20 (3.28%)

NYSE · Last Trade: Jan 27th, 2:28 PM EST

Detailed Quote

| Previous Close | 36.61 |

|---|---|

| Open | 37.50 |

| Day's Range | 37.40 - 37.97 |

| 52 Week Range | 23.05 - 36.90 |

| Volume | 43,795,460 |

| Market Cap | 70.35M |

| Dividend & Yield | 2.054 (5.43%) |

| 1 Month Average Volume | 28,296,019 |

Chart

News & Press Releases

Emerging markets are outperforming the S&P 500 by the widest margin since 2009, driven by strong earnings growth, reforms and valuations.

Via Benzinga · November 19, 2025

In July, Trump imposed 50% tariffs on Brazil due to the trial of former President Jair Bolsonaro over plotting a coup.

Via Stocktwits · October 27, 2025

The move will be in accordance with a law passed in Brazil’s Congress earlier this year, which allows the government to respond to trade measures such as tariffs.

Via Stocktwits · August 29, 2025

US Soybean Exports Hit As Trump’s Tariffs Drive Chinese Oilseed Importers to Brazil, Other South American Countriesstocktwits.com

Via Stocktwits · August 13, 2025

Brazil’s Lula Speaks With China’s Xi As Trade Disputes With Trump Stay On The Boilstocktwits.com

Via Stocktwits · August 12, 2025

Europe is, again, facing extreme difficulties. But this time, it feels different and more profound.

Via Talk Markets · January 23, 2025

In response to Trump tariffs, the Brazilian President has flagged reciprocal levies if the U.S. tariffs go into effect by the Aug. 1 deadline set by the U.S. President.

Via Stocktwits · July 15, 2025

Brazil's President, Luiz Inácio Lula da Silva issued a warning Thursday, July 10, about potential retaliatory tariffs if the U.S. proceeds with its planned 50% tax on Brazilian imports from Aug. 1.

Via Benzinga · July 10, 2025

A quiet day on Wall Street turned into a major win for airline investors Thursday, as Delta Air Lines Inc.

Via Benzinga · July 10, 2025

MercadoLibre stock was down more than 3% in Thursday trading after Trump threatened a 50% tariff on Brazil, MercadoLibre's largest market.

Via Investor's Business Daily · July 10, 2025

The iShares MSCI Brazil ETF (EWZ), which tracks Brazilian firms, fell 2% in extended trading.

Via Stocktwits · July 10, 2025

Emerging markets thrive despite tariff chaos, best positioned to weather volatility: India, UAE, LatAm, and Australia stand out. Defensive sectors and gold are also key for a tariff-resistant portfolio.

Via Benzinga · April 24, 2025

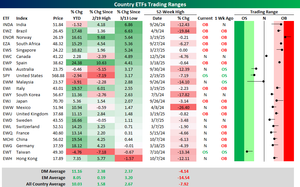

Whereas the US is down low single digits this year, most other countries have in that time risen well into the double digits.

Via Talk Markets · March 27, 2025

In an era of global economic shifts, investors are increasingly looking beyond U.S. domestic markets to diversify and maximize returns.

Via Talk Markets · March 27, 2025

A clear rotation into these cheap markets might only be the start for investors to consider sending their capital to these emerging markets today.

Via MarketBeat · March 21, 2025

The 2025 budget targets a 15 billion reais ($2.66 billion) primary surplus, higher than the initial 3.7 reais.

Via Talk Markets · March 20, 2025

I’m not going to be happy until the entirety of the index gains from 2009 are destroyed.

Via Talk Markets · February 23, 2025

With earnings season in full swing, there’s no such thing as a dull afternoon.

Via Talk Markets · January 30, 2025

There's something to be said for active management; if I had just sort of crossed my arms and let the Sling and Arrows of Outrageous Fortune come along, it would have been bad. As it is, my 13 bearish positions are holding up nicely.

Via Talk Markets · January 25, 2025

Since the elections a little over two and a half months ago, the S&P 500 (SPY) has risen 5.42% through today. That's better than any of the other key country ETFs.

Via Talk Markets · January 21, 2025

Brazil has a budget deficit that's 10% of GDP. In other words, it's spending significantly more than it earns in revenue.

Via Benzinga · December 30, 2024

There's more to the Brazil story, especially since Brazil's story isn't strictly about Brazil. With markets there spiraling into chaos, the government is down to blaming 'speculators'.

Via Talk Markets · December 22, 2024

Brazil's real plunges as investors doubt Lula's budgetary plans. Finance Minister warns of speculative attacks, currency falls further. EWZ down 34% in 2024.

Via Benzinga · December 18, 2024

Mexico's President has ordered a review of a bill to ban open-pit mining, citing its importance to the economy and potential impact on key resources.

Via Benzinga · December 16, 2024

South Korea (EWY) is by far the worst performer today and it is also now the only one trading at a 52-week low too.

Via Talk Markets · December 3, 2024