Alger Small Cap Focus Fund Class C (VWAGY)

10.58

+0.05 (0.47%)

OP · Last Trade: Mar 10th, 3:38 PM EDT

Via Talk Markets · March 10, 2026

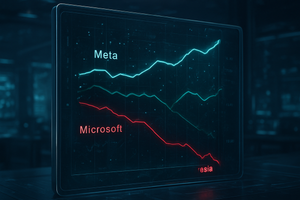

As of March 10, 2026, the era of the "Magnificent Seven" moving as a monolithic block has come to an abrupt and jarring end. For years, these tech titans served as the undisputed engine of the global markets, but the first quarter of 2026 has witnessed a dramatic "dispersion." Investors

Via MarketMinute · March 10, 2026

Date: March 10, 2026 Introduction As of early 2026, Tesla Inc. (NASDAQ: TSLA) stands at a defining crossroads that will determine the trajectory of the automotive and tech industries for the next decade. No longer viewed strictly as a car company by its most ardent supporters—nor dismissed as a mere "meme stock" by its harshest [...]

Via Finterra · March 10, 2026

These three stocks have serious potential over the next decade, even if the media doesn't pay too much attention to their success.

Via The Motley Fool · March 7, 2026

As of March 6, 2026, Tesla Inc. (NASDAQ: TSLA) finds itself at a historical crossroads. Once the undisputed vanguard of the global electric vehicle (EV) revolution, the Austin-headquartered titan is currently navigating a complex "identity transition." The company is shifting its strategic weight from a pure-play automotive manufacturer toward a multifaceted powerhouse of "Physical AI" [...]

Via Finterra · March 6, 2026

The solid-state battery maker faces macro and micro challenges.

Via The Motley Fool · March 5, 2026

As of March 5, 2026, Tesla, Inc. (NASDAQ: TSLA) finds itself at a historic inflection point. Long celebrated as the undisputed leader of the electric vehicle (EV) revolution, the company has spent the last 24 months navigating a "identity transition" that has polarized Wall Street. While the automotive industry globally is grappling with a cooling [...]

Via Finterra · March 5, 2026

European automotive stocks experienced a significant relief rally this week, as markets reacted to a series of legal and executive shifts in Washington that averted a worst-case trade war scenario. Investors, who had spent much of late 2025 and early 2026 bracing for punitive "reciprocal" tariffs that could have reached

Via MarketMinute · February 26, 2026

While Rivian's stock outperformed last year, it is down 21% this year. What's RIVN's 2026 forecast as the company prepares to launch its R2 vehicles later this year?

Via Barchart.com · February 25, 2026

In a dramatic escalation of international trade tensions, the global economic order has been thrown into disarray this week following a series of rapid-fire developments in Washington D.C. On February 24, 2026, the European Commission officially announced the freezing of all ratification processes for the landmark "Turnberry Deal," while

Via MarketMinute · February 24, 2026

BRUSSELS — In a dramatic escalation of global trade tensions, the European Parliament officially voted on February 23, 2026, to halt the ratification of the "Turnberry Agreement," a landmark trade deal intended to stabilize the multitrillion-dollar economic relationship between the European Union and the United States. The suspension follows a week

Via MarketMinute · February 23, 2026

The next-generation battery developer is making important progress in its business, but is it a buy today?

Via The Motley Fool · February 22, 2026

The launch of its new R2 SUV is expected to spark demand.

Via The Motley Fool · February 20, 2026

Rivian's fourth quarter was marked by a significant year-over-year sales decline, but the market responded positively due to the company’s progress in cost reduction and operational efficiency. Management credited improvements in average sales price and lower production costs for driving the first full year of positive gross profit, despite lower sales volumes. CEO RJ Scaringe highlighted the R1S’s performance as the best-selling premium electric SUV in several key states and pointed to advances in the company’s software and autonomy platforms as additional contributors to quarterly results. CFO Claire McDonough emphasized that continued operational discipline and material cost reductions led to an over $1.3 billion year-over-year improvement in gross profit.

Via StockStory · February 19, 2026

Rivian is hoping to break into the mass market for electric vehicles in 2026.

Via The Motley Fool · February 18, 2026

Sentiment was further weighed down by signs that Rivian has delayed its international R2 rollout.

Via Stocktwits · February 18, 2026

In a dramatic shift for the electric vehicle (EV) sector, Rivian Automotive, Inc. (NASDAQ:RIVN) saw its shares skyrocket by 26.6% following the release of its Q4 and full-year 2025 earnings report. The surge, which took place on February 13, 2026, marks a definitive turning point for the Irvine-based

Via MarketMinute · February 17, 2026

QuantumScape's stock could have significant upside.

Via The Motley Fool · February 17, 2026

In a dramatic shift for the electric vehicle sector, shares of Rivian Automotive, Inc. (NASDAQ: RIVN) surged more than 26% following a blockbuster fourth-quarter earnings report and confirmed progress on its multi-billion-dollar joint venture with Volkswagen Group (OTC: VWAGY). The rally, which saw the stock climb to $17.73 by

Via MarketMinute · February 17, 2026

Rivian will begin deliveries of its R2 fleet in the second quarter of 2026.

Via The Motley Fool · February 17, 2026

Rivian said the "complexity" of rolling out the lower-priced SUV will hurt gross profit in early 2026 before becoming a tailwind later in the year.

Via Stocktwits · February 17, 2026

On February 16, 2026, the electric vehicle (EV) sector witnessed a seismic shift in investor sentiment as Rivian Automotive (NASDAQ: RIVN) surged by 26.6% in a single trading session. This dramatic rally, which pushed the stock to $17.73, followed a blockbuster 2026 outlook and a series of strategic partnership headlines that have effectively silenced long-standing [...]

Via Finterra · February 16, 2026

Nio and Rivian are both relatively young EV producers, but the market conditions they're faced with could not be more different.

Via The Motley Fool · February 16, 2026

Tesla's core EV business appears to be hitting a wall, forcing it to accelerate the developmental timelines of several of its side projects.

Via The Motley Fool · February 15, 2026

Turning around its business in Europe will be a big win, but what it could learn from a Chinese rival might be even more valuable.

Via The Motley Fool · February 14, 2026