Barrick Gold Corporation (ABX)

8.2300

-0.0900 (-1.08%)

NYSE · Last Trade: Jan 24th, 6:23 AM EST

Barrick Mining Corp (NYSE:B) Emerges as a Top Affordable Growth Stock Pickchartmill.com

Via Chartmill · January 24, 2026

As the first month of 2026 unfolds, a dramatic shift in market leadership is reshaping investor portfolios. For years, the dominant narrative was the unstoppable ascent of mega-cap technology, but by January 23, 2026, that story has encountered a significant rewrite. Investors are aggressively rotating out of high-flying AI and

Via MarketMinute · January 23, 2026

As of January 23, 2026, Newmont Corporation (NYSE: NEM) stands at a historic crossroads. The world’s largest gold producer is navigating a landscape defined by paradox: a staggering bull run in gold prices that has propelled the metal toward $4,500 per ounce, contrasted against a multi-year struggle to contain ballooning production costs. Following the massive [...]

Via Finterra · January 23, 2026

In a historic week for precious metals, the mining sector has decoupled from broader market volatility, embarking on a vertical ascent as gold prices target the psychological $5,000 per ounce barrier. This morning, shares of Newmont (NYSE: NEM) surged over 6.5% following a safe-haven rally that has seen

Via MarketMinute · January 23, 2026

The global financial landscape is currently undergoing a tectonic shift as a series of "geopolitical bombshells" have sent investors fleeing from traditional paper assets toward the oldest form of security: hard money. As of late January 2026, the commodities markets are witnessing a historic surge, with gold shattering the $4,

Via MarketMinute · January 23, 2026

The global financial system was thrust into uncharted territory this week as spot gold prices exploded past the psychological $4,600 per ounce threshold, fueled by a constitutional crisis at the heart of the world’s most powerful financial institution. The surge follows the bombshell announcement of a criminal investigation

Via MarketMinute · January 23, 2026

In a historic trading session that has sent shockwaves through global financial markets, gold futures surged to a staggering all-time high of $4,920 an ounce today, January 22, 2026. This meteoric rise represents a paradigm shift in the perceived value of hard assets, as a "perfect storm" of geopolitical

Via MarketMinute · January 22, 2026

Major U.S. equity markets surged on Wednesday after President Donald Trump announced a pivotal shift in his administration's Arctic strategy, backing away from a proposed "Greenland Tax" that had threatened to ignite a trade war with European allies. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite

Via MarketMinute · January 22, 2026

In a historic week for commodities, gold and silver have surged to unprecedented record highs, cementing their status as the ultimate safe havens in an increasingly fractured global economy. As of today, January 22, 2026, gold is trading near a staggering $4,822.25 per ounce, while silver has captivated

Via MarketMinute · January 22, 2026

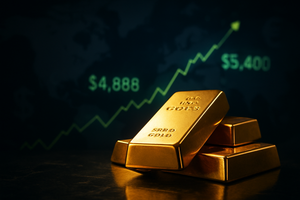

The global gold market reached a historic fever pitch this week as spot prices shattered all previous records, testing the $4,888 per ounce level during intraday trading on Wednesday, January 21, 2026. The surge marks a definitive escalation in what analysts are calling a "structural bull market," driven by

Via MarketMinute · January 22, 2026

Investors often group gold ETFs together, but the VanEck Gold Miners ETF (GDX) and the SPDR Gold MiniShares Trust (GLDM) respond to gold prices in different ways. Here's what sets them apart.

Via The Motley Fool · January 21, 2026

Via Benzinga · January 21, 2026

The global financial landscape was thrown into chaos on January 20, 2026, as President Donald Trump intensified his administration’s pursuit of Greenland, issuing a sweeping tariff ultimatum against eight European nations. The announcement, which ties the continuation of transatlantic trade relations to the "complete and total purchase" of the

Via MarketMinute · January 21, 2026

The global financial landscape has been upended as gold and silver prices surged to unprecedented heights this week, driven by an escalating series of geopolitical shocks and a burgeoning crisis of confidence in U.S. monetary institutions. Gold prices have decisively cleared the $4,650 per ounce mark, while silver

Via MarketMinute · January 21, 2026

The U.S. Producer Price Index (PPI) for November 2025, released late due to a significant federal government shutdown, showed that wholesale prices rose by a modest 0.2%. This figure came in slightly below the 0.3% consensus expected by economists, initially sparking optimism that the "last mile" of

Via MarketMinute · January 21, 2026

Barrick Mining sits on a treasure trove of gold and copper and some analysts believe the high-flying stock is undervalued.

Via The Motley Fool · January 21, 2026

As the global financial markets navigate the opening weeks of 2026, a massive structural shift has taken hold of the commodities sector. Industrial and precious metals are currently undergoing a historic price surge, with gold, silver, and copper all testing psychological and technical ceilings that were once thought unreachable. This

Via MarketMinute · January 20, 2026

As of January 20, 2026, the global commodities markets are witnessing an unprecedented flight to safety. Gold prices have surged to a staggering record high of $4,740 per ounce, while silver has shocked the industrial world by climbing toward $95.50 per ounce. This dramatic appreciation in precious metals

Via MarketMinute · January 20, 2026

In an unprecedented display of safe-haven demand, spot gold prices have shattered all previous records, surging past the $4,300 per ounce milestone in mid-January 2026. This historic rally marks a watershed moment for global financial markets, as the "yellow metal" transitions from a defensive hedge to the primary engine

Via MarketMinute · January 20, 2026

As the price of gold shatters historical records, reaching a staggering $4,600 per ounce, the world’s two largest gold producers are locked in a high-stakes corporate standoff that could redefine the global mining landscape. Rumors are swirling across Wall Street and Bay Street that Newmont Corporation (NYSE: NEM)

Via MarketMinute · January 20, 2026

As of January 20, 2026, the global financial landscape is undergoing a tectonic shift, marked by a migration into bullion. Led by the People’s Bank of China (PBOC) and a cohort of emerging market sovereigns, central bank gold accumulation has reached a fever pitch, with China alone estimated to

Via MarketMinute · January 20, 2026

As of January 20, 2026, the global mining sector has officially entered what analysts are calling a "Golden Age," marked by a historic decoupling of production costs from soaring precious metal prices. This week, Newmont Corporation (NYSE: NEM) shattered expectations by crossing the $106 threshold, while its primary rival, Barrick

Via MarketMinute · January 20, 2026

In a seismic shift for global financial markets, spot gold prices have surged to an unprecedented $4,700 per ounce, while silver has rocketed to a record $95 per ounce as of January 20, 2026. This massive flight to safe-haven assets follows President Trump’s bombshell announcement of a 10%

Via MarketMinute · January 20, 2026

Barrick Mining (B) shares climbed after naming Helen Cai CFO effective March 2026, tapping her 20+ years of finance experience.

Via Benzinga · January 20, 2026

The foundations of American institutional stability are currently facing their sternest test in decades as the Department of Justice (DOJ) moves forward with an unprecedented criminal investigation into Federal Reserve Chair Jerome Powell. As of today, January 19, 2026, the global financial community is grappling with the fallout from the

Via MarketMinute · January 19, 2026